|

12/27/2021 A Chronological Review of EVERYTHING That Happened in The Mortgage Industry in 2021Read NowBY RICH SWERBINSKY, PRESIDENT & COO OF THE MORTGAGE COLLABORATIVE Darth Calabria and non-owner caps, wholesale lender brawls, bidding wars on homes, exploding lumber prices, new leaders at HUD/FHFA/Ginnie & the CFPB, record high home price appreciation, record low housing inventory levels, tapering, and Zoom firings. And this was supposed to be a calm year for the mortgage industry coming off the heels of the pandemic-inspired madness that ensued in 2020. Get comfortable, grab your favorite beverage, and join us on a trip down memory lane for a review of everything that happened in the mortgage industry in 2021. 2021 Acquisitions of Note

JANUARY – Darth Calabria Puts Fannie & Freddie into Self Destruct Mode

On January 14th, six days before the inauguration of President Biden, FHFA Director Mark Calabria and Treasury Secretary Steven Mnuchin announced an agreement to amend the Preferred Stock Purchase Agreements between Treasury and Fannie Mae and Freddie Mac to move the GSE’s toward capitalization levels consistent with their size, risk, and importance to the U.S. economy. At the time, it hardly made news. People thought Calabria would resign, MBA didn’t throw a public fit about it, the amendments are lengthy documents, and the Treasury/FHFA news release kind of glossed over the elements of these amendments that would negatively impact housing finance and mortgage lenders. A couple months later all hell broke loose. Rohit Chopra, one Elizabeth Warren’s “I’ll drop out of the Presidential race and support you” parting gifts, was nominated to be the new CFPB Director. United Wholesale Mortgage went public via SPAC, making the fiery former Michigan State hoops benchwarmer Mat Ishbia INSANELY RICH in the process, even after the stock tanked after going public. FEBRUARY – Housing & Mortgage in the Spotlight on Super Bowl Weekend

February was a slow news month, but Super Bowl weekend saw the housing market in the spotlight. Saturday Night Live ran an epic skit featuring David from Schitt’s Creek poking fun at American’s pandemic-fueled obsession with online house browsing. And Guaranteed Rate and Rocket Mortgage spent some of that refinance boom money on Super Bowl ads, with the latter’s winning most of the immediate reaction online polls for best ad of the year. MARCH – Ishbia Makes Customers “Bend the Knee”, Marcia Fudge Makes History, All Hell Breaks Loose as Calabria Implements Non-Owner Caps on Lenders

Things started to get crazy in March. In the culmination of a budding turf war between Michigan mortgage giants United Wholesale Mortgage and Rocket Mortgage that got REALLY UGLY the prior summer, UWM bomb thrower/CEO Mat “Don’t Call Me Matt” Ishbia issued an edict to all his mortgage broker customers – sell to my most hated competitors (Rocket & Fairway) and you can’t sell to me. In more uplifting news, Marcia Fudge was confirmed as the first woman of color to lead HUD in more than four decades. And then the PSPA amendment shoe dropped in mid-March, as Fannie and Freddie started informing lenders they’d be capping their non-owner-occupied sales at 6% of total loan sales to the GSE’s as second home and investment property lending was booming, unbeknownst to those imposing those edicts. APRIL – House & Lumber Prices EXPLODE

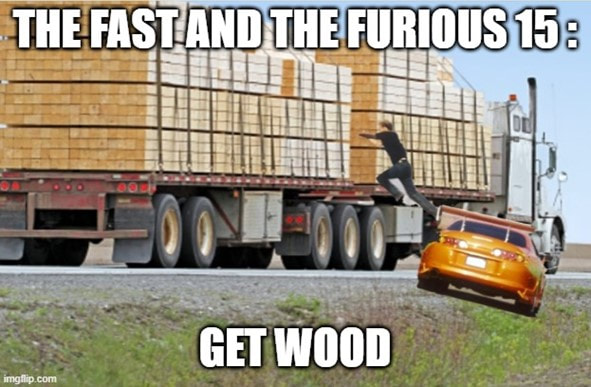

April was the month where the escalation of house and lumber prices reached a head. Builders were essentially put on the sidelines. And throughout the month, we continued to hear (and personally experience) story after story about 50+ offers coming in on homes the first day they were on the market and houses selling for ridiculous amounts over asking price with those buyers waiving inspections and other standard buyer protections. MAY & JUNE – Calabria is OUT, Sandy T is In

May and June were quiet months as those of us in the industry kept an eye on the Supreme Court’s queue of cases, knowing they were getting close to ruling on if the structure of the FHFA was constitutional. On June 23rd, when they ruled it was not, President Biden was then allowed to replace the Director, which he immediately did, canning Darth Calabria and replacing him with long-time Bureau deputy Sandra Thompson, which the industry applauded. JULY – THE ADVERSE MARKET FEE IS GONE!!!!

The clear highlight of the month was when new FHFA Director Sandy T made A LOT of friends in the mortgage industry by eliminating the half-point “adverse market fee” that Fannie and Freddie were extorting from unknowing Americans that were refinancing by the droves. AUGUST – Delta Variant Reinvigorates Refi Boom, Home Value Appreciation Reaches Ludicrous Speed

Just when we thought there might be a light at the end of the tunnel with the pandemic, the world got introduced to The Delta Variant. And just when we thought the never-ending refinance boom was over, it wasn’t. House values also set records for year-over-year increases, turning homes into cash registers for Americans. And FHFA made more news by announcing their intention to implement aggressive goals for Fannie and Freddie related to minority and low-income lending. SEPTEMBER – Sandy T Strikes Again, Suspending Controversial PSPA Amendments

President Biden started the month of September off by releasing a plan chock full of ideas and initiatives that would be hard to implement and have little to no impact on the lack of affordable housing in America that we’ve not heard anything else about now three months later. Then rallied by making a smart nomination of Alanna McCargo to lead Ginnie Mae. Then Sandy T dropped the hammer again by lighting fire to Darth Helmet’s proposed PSPA Amendments. And in the latest edition of “Male Leaders in the Mortgage Industry Can’t Stop Making Bad Headlines And We Wonder Why Our Industry Still Has A Reputational Problem”, loanDepot czar Tony Hsieh was accused by his ex-COO of operating recklessly to grow volume in the leadup to them going public. OCTOBER – The Mortgage Industry’s Reminded About the Flip Side of Democrat Leadership

What has been a terrifying first three months to the Rohit Chopra era as CFPB Director commenced in early October when Chopra’s nomination was approved 50-48 by the Senate, with Vice President Kamala Harris having to cast a tie-breaking vote to end debate. Republicans were united in their opposition to Chopra, citing Chopra’s record as a cause for severe concern. GOP senators also insisted that Chopra should be disqualified from leading the CFPB after refusing to respond to questions about the acting director’s dismissal of some bureau staff. “It's clear to me that Commissioner Chopra would very likely return the CFPB to the rogue, unaccountable, anti-business agency it was during the Obama administration," said Senator Pat Toomey of PA, the top Republican on the Senate Banking panel, in a speech before the vote. Chopra would go on to levy a $5M fine to a bank later in the month. And has also called out Big Tech, declared a war on overdraft fees, and attempted a hostile takeover of the FDIC during his first 90 days on the job. NOVEMBER – Zillow, NY CRA, Tapering, Infrastructure Bill, Lower Our Damn FHA Insurance Premiums, JPow Re-Upped, New Loan Limits

November was a roller coaster ride of baffling news stories that impacted our industry. Starting with Zillow announcing that as a company that values homes, they’ve improperly valued the ones they’ve bought and would be shuttering their ibuying business and jettisoning a quarter of their employees in the process. On the same day, the state of NY said they’d be holding independent mortgage bankers responsible to meet CRA guidelines bestowed upon banks due to their ability to take in government-insured deposits in the state even though IMB’s don’t take in deposits. JPow announced he’d be tapering bond purchases and was ultimately renominated by President Biden over Democrat Lael Brainard. Affordable housing initiatives continued to be kicked to the curb, with those initiatives being left on the cutting room floor in the skinnying down of the infrastructure bill. As politicians continued during the month to make moves to increase demand and do nothing for supply (with housing inventory at a historically low level), they also complained (rightfully so) about the homeownership rates of minority and lower income Americans and then announced there’d be no reduction to FHA insurance premiums with the MMI insurance fund at over 4X statutory levels and insurance premiums at historic highs. Then the government said Fannie and Freddie would now buy mortgages up to $647,200 (and close to $1M in higher cost areas) because we all know how much help those homeowners in America with mortgages between $550-$650K need. DECEMBER – Housing Inventory Hits an All-Time Low, The Megatron Variant Wreaks Havoc, the Mean Guy from Better.com Goes VIRAL, and Sandy T is Made Official

I’m not sure what’s scarier – the Megatron variant or the Better.com guy, but both TERRIFIED Americans in December. And the CFPB continued to terrify the mortgage industry (or at least those paying attention) by tipping their hand at what’s coming down the pike in ’22.

4 Comments

Jodi Hall

12/28/2021 12:36:09 pm

And the new URLA was implemented. That was 2021, right? Other than that, not much going on.

Reply

Gabriela Mendicino

12/28/2021 12:37:48 pm

Oh, not much at all. Hopefully in 2022 something actually exciting will happen!

Reply

denniSTR

11/30/2023 01:24:18 am

Thanks for your informative post, I was able to read it thanks to a writing service <a href="https://www.nursingpaper.com/">nurses essay writing</a>, and in the meantime, I can read your wonderful post while they do my work for me!

Reply

Leave a Reply. |

Details

Archives

July 2024

Categories |

|

The Mortgage Collaborative © 2023

|

RESOURCES |

RSS Feed

RSS Feed